October Has Us moving away from this "magic rate" for mortgages

1-Interest rates have ticked

After hitting a 16-month low of 6.11% in early September, the average 30-year fixed-mortgage rate tracked by Mortgage News Daily has ticked back up, reaching 6.62% last Tuesday.

2-Why Did they Tick up?

After the FED’s cut short term rates . . . now keep in mind, this does not directly drive mortgage rates but rather is seen as a gauge of the overall economy . . .

After they cut those short term rates, the unemployment rate did the opposite of what they were expecting which is it went down . . . The rate went from 4.3% in July to 4.1% in September. These is seen as a sign that the economy is still running hot and that puts a little upward pressure on long-term yields, such as mortgage rates.

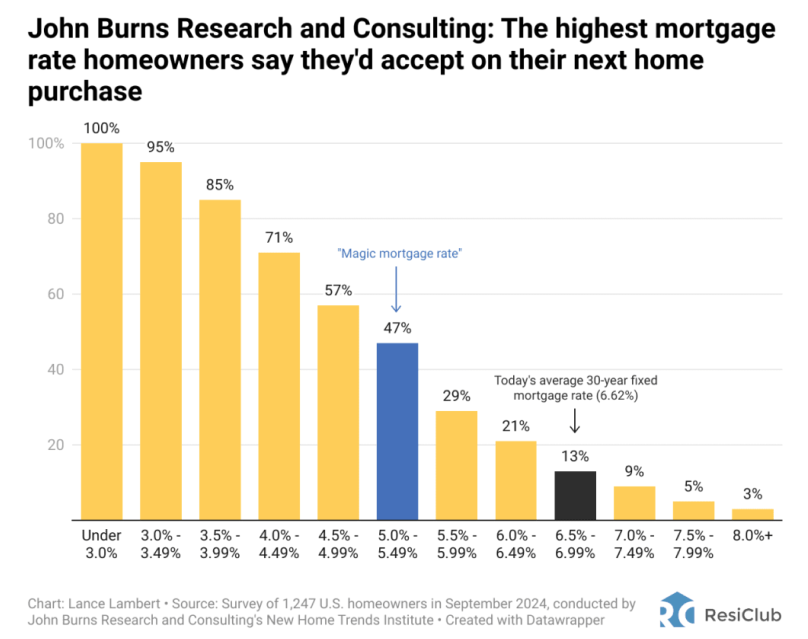

3-The Magic Rate that will Unlock the Housing Market

The “magic mortgage rate” that JBREC says would truly unlock the housing market is below 5.5%. The research firm has held this view for a while and reaffirmed it last week, citing its September 2024 survey.

Only 13% of homeowners surveyed by JBREC said they would accept a mortgage rate between 6.5% and 6.99% on their next home. But 47% said they would accept a mortgage rate between 5.0% and 5.5%.

Leave a Reply